In the digital era, rapidly changing digital and mobile channels are generating challenges that banks must deal with. One of the biggest comes in the form of customers’ expectations, which are soaring.

Opening an account, transferring money, managing finances via smartphones. And this is just the tip of the iceberg. It’s not about providing the most competitive offer any more. It’s about being with customers everywhere, all the time.

Then how do you improve online banking services to achieve this goal? The answer is, apply customer journeys to create and implement the right digital and mobile strategy.

Planning this strategy is a tough task, so in this post we’ll discuss key issues to put you in the right direction. In 4 steps we’ll:

- explain why the customer journey in banking should be analyzed in a broader context than just touchpoints.

- develop the concept of micro journeys and highlight their significance for your digital banking strategy.

- guide you through one of the journeys to better understand your customers.

- provide you with solutions to optimize channels across the customer journey.

Step 1. Build your e-banking strategy around an end-to-end customer journey

However important, a mere cross-channel presence is not enough to guarantee a bank’s market position and deliver an effective digital banking customer experience. The most important thing is to acquire a broader context of customer interactions and shift your approach from touchpoints to the customer journey in banking.

This journey integrates before, during and after transactional experiences. So it takes time and involves multiple channels and touchpoints. Even the most basic examples, like customer onboarding or helping customers solve technical issues, happen in a context you can’t ignore. Otherwise, as McKinsey’s research has demonstrated, organizations can lose clients, see declining sales, and even lower employee morale.

The benefit of the journey methodology is how it reveals inconsistencies, both in terms of channels and touchpoints. These can be related to prices, terms and conditions, offer descriptions, and many other things.

Most importantly, it lets mobile and online banks step into their customer’s shoes, to understand both what they need and simply want. Once you have this knowledge, you can fulfill their wishes and give customers the services they desire most.

The growing importance of digital channels among banks’ customers is nothing new. It’s been stressed in numerous surveys. According to a report by the global IT consulting firm CGI, 90% of 14,000 surveyed consumers favor online banking services. In this regard, neither age, income, residence nor type of bank plays a role. It’s clear that this is a fundamental means of delivering financial services on today’s market.

Worthy of particular attention is the fact that one particular channel – mobile – is gaining momentum. As the App Annie Report tells us, within just the last two years in France the adoption of mobile banking has more than doubled.

Although customers use it mainly to check balances, make internal transfers or manage their budget, it shows a rising trend in customer preferences and reveals a substantial focus area for banks to work on.

Step 2. Recognize small trips that make the whole journey count

As we’ve already mentioned, the customer journey, both in mobile and online banking, is a bridge connecting interaction channels and touchpoints. It varies from one customer to another. Here we are aiming to present a universal approach showing the micro journeys that form a representative one.

Free Ebook: 6 Steps to Start Capturing Customer Journey in e-Banking and m-Banking

Learn how to improve customer experience and UI of the e-Banking and m-Banking platforms

Trip #1. Customer onboarding

Although a lot of effort has been expended, banks seem to be losing ground to fintech companies in their support of major stages of the digital journey, especially opening accounts.

One of the key reasons is discussed in the report “State of the Digital Customer Journey” presented by Financial Brand, which says that “the vast majority of financial institutions can’t open a new account entirely online or on a mobile device.”

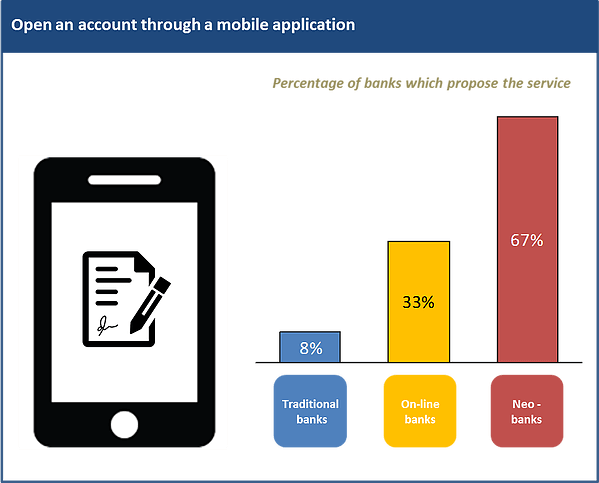

Report on the French banking sector: opening an account via mobile app. Source: D-Rating

But why is that so important? Simply because journeys that let customers go smoothly through the whole process without switching channels lead to greater satisfaction.

If a customer wants to open an account using a mobile device, they don’t need to print documents, call customer service, or visit a branch to get the job done. In this way, they’re given what they expect and every step in their “trip” is convenient, easy, and seamlessly integrated.

That said, the lack of consistent digitalization is not the only problem. Banks also need to consider the time needed to open an account.

As observed by D-Rating, a digital performance rating agency, in France you can set up an account in neo-banks within a few minutes. No other French bank makes it possible to do this in less than 48h, and the process involves going to a bank branch. In practice, the process can take between 3 to 15 days.

Trip #2. Getting real-time account balance

Another micro journey is getting account balances to acquire real-time insights into transactions using a mobile app. This option is provided only by neo-banks, leaving traditional and digital banks far behind.

Only one bank among those analyzed by D-Rating was able to display a balance and money transfers instantly. As the real-time experience is a key factor in digital services, it should be at the top of the improvement list for the banking industry.

Trip #3 Finance management

It was online banks that took the lead in Personal Finance Management, and nowadays many banks provide an expenses classification.

This is an essential element of PFM. What’s more, customers have external accounts aggregators which offer a full view of their accounts, including those from other banks. This lets customers keep a finger on the pulse of their budget.

The future will bring even more advances to this process. According to Finextra, banks worldwide are preparing for a new mobile service called bot-advisors. Just imagine having a personal bank advisor 24/7 at your disposal that can:

- send you reminders about upcoming payments

- recommend different saving plans

- tell you how much you spent on car repairs this month

These programs, driven by rule or machine learning, will cut banks’ expenses on human advisors while offering their customers precise just-in-time advice.

Mobile banking in France offers expense classifications and external accounts aggregators. Source: D-Rating

Trip #4 Money transfer

When it comes to customer convenience and delight, transferring money by sms and adding new recipients is crucial. These services vary among banks. The validation process may make adding recipients particularly troublesome. As stated by D-Rating, only one-third of the analyzed traditional banks offers such service.

Trip #5 Card control

Providing users with 24/7 control over their card is a significant step in the journey. In the event a credit card is lost or stolen, instant deactivation is crucial.

For example, in France, card deactivation via a device is only available at neo-banks. Some banks let their customers use mobiles to manage online purchases, withdraw cash, and handle transactions in foreign countries. Moreover, the personalization trend in mobile banking is taking off, and customers can set a PIN code of their choice.

Trip #6 Mobile payment

It seems that the mobile wallet is becoming a standard payment method. The Visa 2016 Digital Payments Study revealed that “the number of Europeans regularly using a mobile device for payments has tripled since 2015 (54% vs 18%).” This fact adds considerable weight to improving the digital banking customer experience in this phase of the customer journey.

Step 3. Dig into the details of the customer journey to get the big picture

Opening an account from searching for information to final verifying transfer. A use case from Bank Zachodni WBK presented in Forrester’s report.

The above example demonstrates the three stages of the customer journey involved in opening an account on-line. It shows the user’s needs and issues across all touchpoints and communication channels.

It starts with a search for basic information: how much a card costs, how to apply, how long the process takes to complete, and it finishes with sending the first transfer.

As the journey progresses, it leads to more questions, more detailed inquires, and involves more communication and interaction.

The closer we get to finalizing the process, the more critical issues come to the surface. This makes it important to analyze the customer’s involvement and reactions in order to address them in a suitable and compelling way.

The concerns a certain stage raises, like:

- how long the offer is valid

- whether it’s a safe method of submitting an application

- whether the application was correctly submitted

- how the bank verifies my identity

- how a verifying transfer is made

reveal critical areas to address and improve.

On the contrary, positive customer experiences, namely:

- short time necessary to apply for an account

- the ease of filling out the form

- simplicity of sending the transfer

should influence future plans and strategies, as they proved to be effective.

This single journey, although short, allows you to create a conceptual framework, perceive critical issues, focus on smaller goals, and plan a strategy with the individual customer in mind.

Step 4. Optimize channels throughout the banking customer journey

Every step a customer takes and every channel the customer uses supplies valuable information on the services offered. It provides data that needs to be analyzed then translated into specific action.

In order to obtain comprehensive insights, banks need to apply an analytic engine. This lets them devise engagement strategies built around factual analysis of both past and recent customer behavior.

First of all, proper analysis of banks’ activities is about measuring the performance of campaigns in the context of the whole journey, across all channels. Data dispersed in various locations and legacy systems then needs to be centralized and structured.

A significant increase in leakage rate caused by failure to channel optimization. Source: McKinsey.

The diagram above is taken from the McKinsey report and presents what happens when banks fail to optimize their digital channels. One of the causes of leakage is the failure of banks to improve integration of online and offline experiences.

The bottom line is to acquire a full customer profile, created from detailed information on basic customer data, transactions, preferences, and interactions with the bank. This information is crucial for optimizing digital channels.

Of key importance is how banks engage customers and help them achieve their goals in a simple and efficient way.

With a complete data set at their disposal, banks can perform a thorough analysis of errors, inadequacies, and flaws throughout the journey. What’s more, by using the right analytics tools they can:

- identify the most important patterns in journeys

- uncover new customer segments

- find where customers drop out

- spot new opportunities to engage customers across the whole journey

In their efforts to optimize channels, banks also need to recognize various aspects of the customer experience. For example, convenience. If we consider an individual journey, cutting down the time of opening a bank account by making the process simpler and using personalization to auto-fill certain fields in the application would improve customer satisfaction.

Taking advantage of analytics tools allows banks to understand their customers better and create customized offers and services. It means they can reach their customers at a time they prefer and via their chosen channel. So they aren’t intrusive and are able to provide products that match customer preferences.

Free Ebook: 6 Steps to Start Capturing Customer Journey in e-Banking and m-Banking

Learn how to improve customer experience and UI of the e-Banking and m-Banking platforms

Customer experience in banking – conclusion

As you can see, the customer journey in banking (both mobile and online) requires a holistic approach. You need to apply various tools and methodologies for comprehensive analysis and optimization of every step and touchpoint, all within the right context.

We realize we’ve only just scratched the surface of this complex process. We hope that the guidance we’ve given you on using micro journeys to analyze the customer journey in banking in a broader context will help you devise a better strategy and improve your online banking services.

We know that there’s a lot left to say on this subject. So we’ll have to wait and see where fintech ends up. But for now, we’re waiting and ready to answer your questions right away.